Business Plans That Drive Transactions

Most companies view business planning as a necessary evil. Senior executives would rather be building new technology or talking to customers. For early and growth stage companies, business planning aims to obtain funding to start or expand the business. For more mature companies, the main goal is to drive either an acquisition by a larger player or faster growth and profitability. In reality, the major goal of business planning is to outline the structure and execution steps to create the best possible business.

Over the past 25+ years, we have worked on hundreds of business and operating plans with entrepreneurs that have driven transactions, and we have read hundreds more, many for companies that could have been market contenders if they had been more diligent about plotting out their future. My view is:

Many business plans do not demonstrate depth and operating rigor, and, in the era of extreme due diligence, do not get funded even though the business may have the tools to be successful.

Many business plans make it hard for investors to get excited about an opportunity because they present information in the wrong order and fail to show that the management team can operate the business on a daily basis.

All of your materials—the business plan, operating plan, presentation, executive summary, financial model, and due diligence documents—need to tell the same story and show that you can operate your business in a way that outsiders can understand and make a transaction decision quickly.

For the smart entrepreneur, business planning is the process of thinking ahead, organizing your company for success, and executing that plan—it is continuous, rigorous, and not a one-shot deal. Once you create your first business plan, you update it every month or quarter. It is your roadmap for success, and, aside from your customers, products, shareholders, and employees, it is your most valuable asset.

Where You Are Now

You are going full speed, running your company. You have an operating business, a simple business plan, and some sales presentations and literature. As you continue to trudge on without growth funding, operating your business gets harder and harder. You believe in your market and think you have some customer validation because your product is installed at a couple of companies. Investors may follow your company, but you can’t surpass the “feel-good” first meeting or phone call. You need capital to grow, so that you can:

Fund product development

Hire executive talent

Expand sales

Get the word out to analysts and customers

You know you need a real business plan, so that more people can understand and fund your growth, but operating your company always gets in the way.

Where You Want to Be

Business planning is hard; however, at the end of the day, there is a simple way to approach it. To create a great business plan, an entrepreneur must answer three questions:

The Planning Cycle

What value does your company and its products provide to customers?

What value does your company provide to employees and shareholders?

What is your roadmap for becoming a highly-valued market leader with great customers and employees and highly appreciative shareholders?

The Planning Timeline

To answer these questions, an entrepreneur and his team must go through an iterative, intense process. Creating a great business plan has four, key steps:

1. Research your market and competition. Gather the facts from credible outside sources, like IDC, Forrester, Gartner, and Wall Street analysts. Most business plans lack sufficient description of the market and competition.

2. Use strategic thinking to set your company’s direction and get your team all on the same page. Be fact-based and unemotional in assessing your market position and prospects for success, and identify weak areas where you need more facts and strategic help.

3. Build your tactical plan with a heavy focus on the milestones you must achieve to succeed. While every milestone for each function won’t end up in your business plan, you need to map out in detail the milestones for executing on your product and technology roadmap, sales strategy, marketing roll-out, human resource needs, and financial plan over the next 24 months. By the way, once you have written down these milestones, execute against them successfully along the way. Investors and buyers will watch your progress against your own goals. Finally, build a series of financial models to test your milestone assumptions. Prepare best, worst, and likely cases, and remember that a rational financial model is a good reflection of the management team.

4. Then begin writing. The business plan and investor presentation are the documents you write at the end of the process. They serve as the roadmap for your business for the next 24 to 36 months. To create a great roadmap, you must have your facts in order.

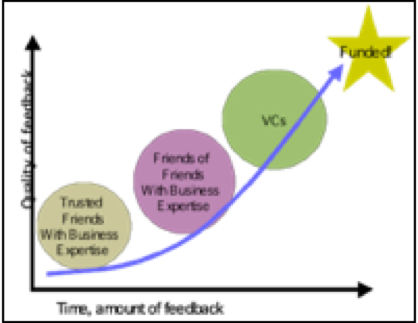

Finally, there is a saying that the favorite beverage of entrepreneurs is Kool-Aid, because entrepreneurs drink their own Kool-Aid constantly, and many companies don’t live to tell their story as a result. You must expose your ideas and thinking to intense criticism and listen to contrary points of view from outside the company. Here are the rules for outside review:

The Review Cycle

1. Get at least 3-5 outside reviews before you go to investors, not including your mom – unless your Mom is Meg Whitman.

2. Use friends, business leaders, board members, consultants – anyone who has industry or operating experience.

3. In your reviews, try to cover all of the key functions of your company – technology, sales, marketing, operations, and finance.

4. Use people you trust who also provide expertise and keep tabs on documents that you believe are confidential, but remember that even investors and reviewers won’t sign non-disclosure agreements to receive your plan.

5. The outside review process ought to hurt and challenge your thinking, or you are not getting the advice you need prior to beginning the funding process.

How do you know you’re getting good advice? Well, the favorite beverage of a good outside advisor is crisp, cold water. The advisor doesn’t drink it; he throws it in your face to make sure you are listening.

Before we discuss what should be in your business plan, presentation, executive summary, and operating plan, let me add one thing: Good business plans aren’t built over a weekend. It almost always takes 45 to 60 days to create a business plan and accompanying presentation on paper.

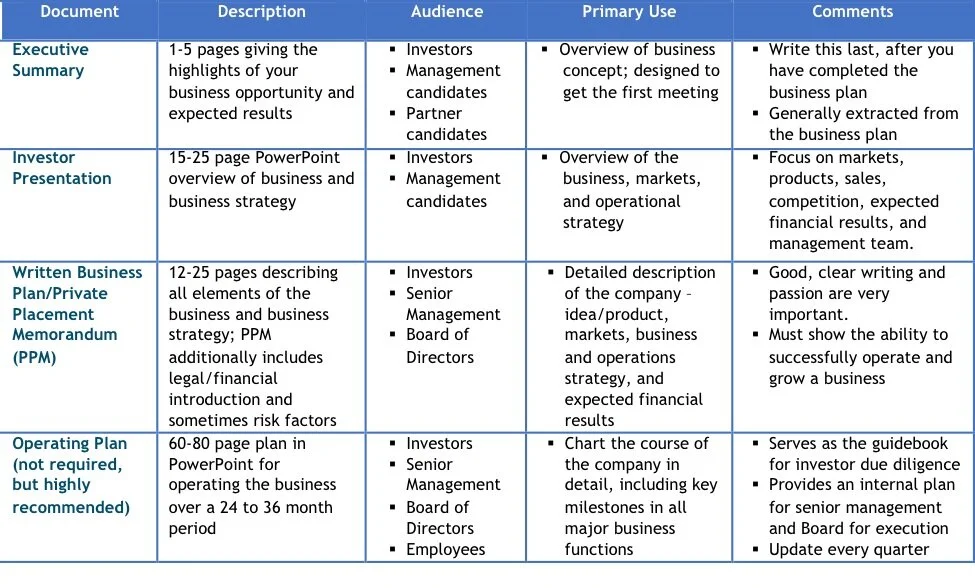

Business Planning Artifacts

What Documents to Create and What to Include

Plan Contents

Solid planning produces several documents that describe your business; each document serves a different purpose in the funding process. Here is the optimal set of documents that you need to produce:

Generally speaking, you create your set of planning documents in the reverse order of their use – beginning with the optional operating plan and ending with the executive summary. Every document should contain some version of these seven sections in increasing levels of detail depending on the length and purpose of the document:

1. Executive Summary – 2 business plan pages – provides a succinct and compelling description of your company. It should include a discussion of the key takeaways in all key areas of your business. The first paragraph or two should clearly state what you do, why it is compelling, and why your company wins in the market. The subsequent content on your market, products, current and target customers, competitive position, management team, and financials should factually support and amplify the summary's beginning. If you have the time to build on your business plan before going to the transaction markets with a summary, I would strongly suggest that you create the executive summary last, after you have documented the rest of your business, so that you have maximum knowledge of all key functions in your business.

2. Market Overview - 2 to 4 pages – describes the market opportunity, the landscape you compete in, and the market drivers that speed adoption of your products. You need to cite third-party sources that support your description of the market opportunity and provide market forecasts that support your predictions of a high-growth market. Sources can include industry analysts (Gartner, Forrester, and IDC), financial analysts (Wall Street brokerage research), and academic and association studies focused on describing the market. You need to relate these market drivers to product capabilities you offer and activities you are seeing in the market. Finally, be sure to document the barriers to entry that will prevent your competitors, large and small, from devouring your company as a luscious but light, mid-afternoon snack.

3. Products & Services – 4 to 6 pages – is where the rubber meets the road. Customers buy products, analysts track products, and investors and acquirers bet on products. Therefore, you absolutely and completely have to describe your products clearly and succinctly. Here is what you need to cover:

A clear and short overview of your products that articulates what the product does, the value it brings to customers, and why it is unique in the market

A description of the major components, capabilities, and benefits of the product or service

Your unique intellectual property:

How the technology is different from and similar to existing technologies?

How hard is it replicate?

Could it become “the standard” for the market? If so, how?

The status of product or service development, including the release date of the next (or first) version of the product or service (or key products if you work for a larger company)

How the product will evolve over time, including a brief description of the features that will be available in subsequent releases

If partners are required to deliver the product or service, the type of partners that are required and briefly provide examples of potential partnership candidates

An overview of how you currently – or will – implement your product for customers. For software products, this usually means building a professional services organization that follows specific implementation procedures.

How your product is positioned and priced in the market

Sample case studies – if you have them – that describe the benefits of your products in real-world use

Most entrepreneurs love to rave endlessly about their products and technology. It becomes tempting to build a 20 page business plan section – or 10 slides in an investor presentation – to really make sure that an investor or acquirer “gets it”; however, it’s better to make it crisp, clear, and concise. Remember that Products & Services is only one section out of seven.

4. Go-to-Market Strategy – 3 to 5 pages – describes how you get your products in the hands of customers. You must prove that your company can grow its customer base and that you know how to put together an effective go-to-market team. You should cover:

The Company’s performance to date, including notable selling, partnership, and marketing highlights over the last 6 to 9 months

The sales strategy in the future, including the use of direct and indirect channels as appropriate

Sales goals by channel for the next 12 to 24 months

How you currently organize your selling efforts and how this will change in the future

The types of people you have on staff – and will recruit – to execute your go-to-market strategy

How you use – or will use – indirect channels to bring your products to market

The marketing programs you expect to execute to help acquire new customers and influence the market

This section can seem particularly daunting for technically oriented entrepreneurs because, as everyone knows, great technology sells itself. If you don’t know how to organize a go-to-market strategy, seek expert advice. As a leader, who happens to be a technical genius, you are expected to be able to put together a logical, metrics-based go-to-market strategy and build the right team.

Avoid Competitive Analysis Mistakes

5. Competition – 2 to 4 pages – takes the market you described in the Market Overview and paints it from a competitive point of view. This section describes:

The major competitors in the different market segments where you compete, including who is there now, who is entering, and who could enter but has not

The major competitive groupings that define the competitive dynamic in the market (e.g., serving large vs. small enterprise; application vs. tool; direct vs. indirect, etc)

The main competitors, how large and established they are

The primary strategy/orientation of each established player and the new player entering the market

The alternatives and substitute products and services available to customers

Winning against the most important competitors, both in terms of classes of competitors and perceived direct competitors that can take money out of your pocket

It is very tempting to trash your competitors, large and small alike; your offerings and approach are obviously better. It’s also tempting to describe them in such excruciating detail that investors and buyers scream in terror. The best approach is to create a high-level, SWOT-oriented view based on more facts and realism than passion for your product. Here are the rules you should follow:

Be fact-based – Investors and acquirers will have their own sources of competitive information, which could be better than yours. You need to be credible, not incredible.

Place the competitors on a matrix with key competitive differentiators defining the two axes. Then, on a second page, provide a factual description and comparison of the competitors. The goal is to show that there are opportunities in the market for your products that your competitors don’t serve well.

There is always a competitor – don’t say there isn’t – but break the types of competitors into groups you can position against and determine how to win against each group. In many markets, there appear to be 12 or 15 competitors, but, when you break down the market by target customer, product features, and other factors, perceived competitors can melt away – leaving your company with a manageable competitive universe.

Be sure to depict how you win graphically, but remember there’s a trap here. A Magic Quadrant that shows you in or on the way to the top right box is great, but only if Gartner created it. You’re better off creating a graphic showing some differentiating features, product breadth, delivery time, market approach, or ROI/TCO.

6. Operations & Management - 2 to 5 pages – describes the major tasks that must be accomplished to take your concept to reality. It also highlights the capabilities of your management team and the near-term management and employee additions you’re going to make to strengthen your team. Specific contents include:

In Operations

A description of the major milestones and tasks over the next 18 months, and how they will be accomplished (products, customer growth, key capacity in place, etc)

The number of and types of employees that will be required to accomplish these milestones

The external events and partnerships that will be required to accomplish these milestones

The obstacles that must be overcome to meet these milestones

In Management

The key management personnel and their backgrounds. Present biographies (1/2 page on average) that are accomplishment and experience-focused

The Board of Directors and/or Board of Advisors and their backgrounds

The major investors that will be adding value going forward

The professional advisors the company has retained: law firm, accounting firm, consultants, etc

The hiring plan and timeline for the next 30-180 days

Your market, products, go-to-market, and competitive strategies may seem like the meat of your plan, but guess what, this section is equally important. First, you’ll outline the key milestones for your business over the next 12 to 18 months. You should be aggressive and positive about your milestones, but remember that you have to meet them. Transactors on the other side of the table will measure your progress against those milestones. In management, you need to tout accomplishments, experience, and your HR plan, but don’t embellish. Investors and buyers check bios and experience, and exaggerations can create a lack of trust. The bottom line is, management counts for a lot – up to 50 percent of your total grade if you’re an early-stage company – and achievability of milestones and personal credibility are king.

7. Financials & Use of Funds – 2 to 3 pages – contains your financial projections, major assumptions, and uses of funds. You should provide enough information for investors or buyers to understand your financial plan but not so much that you have divulged your entire financial strategy and approach. You should also avoid drowning the investor or buyer in financial detail early on. If there is transaction interest, you’ll go through several sessions where you explain how and why you built your financial plan. Generally, this section should include the following financial information:

Actual financial results (if applicable)

Projected financial results (yearly) for the next 3-5 years. This always includes income statement and might sometimes include a statement of cash flows and balance sheet

Revenue & cost assumptions that drive financial projections (units sold, headcount by function, development cost, etc)

Required capital and major uses of funds

The information you include in your transaction documents is just the beginning. As the basis for executing a transaction, you must create, maintain, and update a working, operations-focused financial model. You should keep this model up-to-date monthly. In addition, you should test your assumptions against a series of rules:

Make your numbers big enough to be exciting to transactors but realistic enough to be achievable

Develop your financial projections using both a top-down and bottoms-up approach, so that you can defend your assumptions to a prospective investor

Check your revenue projections against your addressable market size to make sure you are projecting an achievable market share

Check your cost projections against market analogs to make sure your costs are in line with industry norms and investor expectations

Do high, medium, and low scenarios for key assumptions internally to understand the impact of the major revenue and cost drivers. Pick the most realistic scenario for your transaction documents

Test your assumptions with your outside advisors or trusted resources before your first investor meeting

Get a professional to build your model unless you have great modeling skills

The numbers must be the same in all the documents you deliver, so try to get it right the first time

Finally, more than any other part of your business plan, your financial model proves that you – and your team – are sane and logical. During the Internet Bubble, entrepreneurs produced many fanciful financial models lacking sanity and business logic. In the age of AI, this trend is coming around again. I remember showing one of my plans to a friend who ran investor relations for a publicly-traded company. She read the plan from cover to cover and dug into the first six chapters; however, her reaction changed when she got to Chapter Seven, Financials and Uses of Funds. I heard a loud whistle and the words, “What a bunch of hooey!” Fortunately for my client, the exuberance of the Internet marketplace carried the day, and a quality investor contributed $3 million in funding. That’s less likely happen in today’s market.

Some Important Final Words

Your business plan isn’t the final word in making your business successful. Instead, it provides a vehicle for running your business more effectively a. For example, if you successfully raise funds, you earn the right to do even more difficult things daily – such as build a global sales force, branch out into new product areas, partner to reach new markets, and simultaneously manage shareholder, customer, and employee expectations. Your role – and the role of your senior team – is much more difficult than the business planning process, and I certainly admire you, as entrepreneurs, for taking up the challenge.

In closing, I wanted to give you my final three rules on business planning:

1. Good, clear writing makes the transactor’s life – and yours – much easier. If even your closest colleagues can’t decipher or explain what you wrote, find a good writer, explain your idea, and get out of the way. Transactors see hundreds of plans annually, and reading a plan takes at least an hour. Most of these tomes don’t read like “The Da Vinci Code”. Make it easy for them.

2. Mixing pictures and words effectively gets a better result. I have seen dozens of plans that consist of 50 pages of dense writing, justified on the right. Most of them were dizzyingly dull, and I like reading business plans. To avoid being dizzyingly dull, remember this business planning rule:

When reading business plans, there are Word people and PowerPoint people. For maximum success, you have to serve both.

The right pictures, tables, and call-outs will amplify your story and make your business plan more powerful. Also, please note that, in the transaction world, everyone is an Excel person. The rules for rigor in your financial model still hold.

3. Take the time to concentrate on business planning and build it as a team. Involve your team in building the plan. A CEO can burn the midnight oil writing a masterpiece and hope the market agrees. Alternatively, a team can visit the whiteboard, the Internet, the library, customers, advisors, and conferences, and build the best possible plan. It is healthy to have constructive and contentious debate over what features will be delivered in each product release or which markets are right for a product at the outset. It is extremely important to set milestones as a team, and it is even better when engineering understands the approach that the sales team is taking towards customers.

Earlier in this document, I mentioned that building a great business plan takes 45 to 60 days. Consider this the necessary time it takes to start or jump-start a great company—you won’t regret it.